The SuperEasy KiwiSaver Superannuation scheme is an easy way to help you save for the future. Find out how KiwiSaver works, and how it can help you.

About the SuperEasy KiwiSaver Superannuation Scheme

A key feature of SuperEasy KiwiSaver Superannuation Scheme is our Automatic Fund. This fund offers the convenience of one single investment choice that will be reviewed each month, saving you the need to review your investment strategy. Once on board with the Automatic Fund you can relax knowing your investment strategy is well taken care of!

It is a plan that will invest and accumulate savings which are held individually on your behalf in trust, usually until you are eligible to receive New Zealand Superannuation (currently age 65).

However a five-year membership requirement also applies if you first joined KiwiSaver (or a complying superannuation fund) before 1 July 2019. From 1 April 2020 you can opt out of that requirement. If the five-year requirement doesn’t apply you can get your money out of KiwiSaver once you turn 65.

Not only does The SuperEasy KiwiSaver Superannuation Scheme accumulate savings towards your retirement, but it can continue to manage your savings throughout your retirement, well beyond age 65.

Members can transfer existing fund balances from another employer or private superannuation scheme into the SuperEasy KiwiSaver Superannuation Scheme at any time. The SuperEasy KiwiSaver Superannuation Scheme administrator doesn’t charge for this.

Members can also deposit additional lump sums into the SuperEasy KiwiSaver Superannuation Scheme at any time, at no extra cost.

Do you want the convenience of one single investment choice that will be automatically adjusted each month, saving you the need to review your investment strategy as you get older?

We believe your money should work for you every day and we give you online access to your personal account balance so you can track that progress.

Our ability to earn an income is our passport to providing lifestyle choices for ourselves and our families. In short, it helps to maintain our quality of life. To ensure that quality of life continues after we stop working, we need to start planning for it as soon as we can.

Retirement may seem a long way off but the sooner we start saving for it the more enjoyable it will be! Read more on the Commission for Financial Capability’s website.

New Zealand Superannuation will pay you some money. But will this be enough for your retirement? We believe it is a good idea to save for your retirement.

There are only two charges:

- An administration fee of $4.50 per month.

- Annual fund charge of 0.333% pa of your account balance. This fee covers the management of the Scheme, underlying fund manager fees and in-fund costs.

See further information on annual fund charges on this page.

For most people KiwiSaver is work-based, with contributions coming from their employer and out of their pay. Each payday you’ll make a contribution of 3% of your gross salary or wages – or you can opt for a higher rate of 4%, 6%, 8% or 10% if you ask your employer for any of these rates.

Compulsory employer contributions:

All employers are required to match employee contributions for KiwiSaver and complying superannuation funds at a level of 3% of gross salary.

All employer contributions must be made through Inland Revenue, not direct to Civic Financial Services Ltd.

Additional or lump sum contributions:

In addition to the 3%, 4%, 6%, 8% or 10% of your gross salary or wages paid through your employer, you may also make additional, regular contributions or lump sum contributions to the Scheme at any time.

Additional regular contributions are to be remitted to the IRD.

Any additional, regular or lump sum contribution you make may be subject to a minimum amount. Details of the current minimum amount and the appropriate method of payment can be obtained from the Trustee. Any additional, regular or lump sum contribution you make may, or may not, attract a subsidy from your Employer.

New Zealand citizens, and those eligible to be in New Zealand indefinitely under the terms of the Immigration Act 2009, and who are, or normally are, living in New Zealand, can become a member of KiwiSaver. You can also join KiwiSaver if you are a state services employee who is serving outside of New Zealand, on New Zealand terms and conditions, in a jurisdiction where offering KiwiSaver membership is lawful.

Once you join you can remain a member for as long as you wish, even if you leave your employer for whatever reason.

New Zealand citizens and those eligible to be in New Zealand indefinitely under the terms of the Immigration Act 1987 can join the SuperEasy KiwiSaver Superannuation Scheme by contacting the Trustee, provided those persons:

- Are employed by a Local Authority or a Council Controlled Organisation;

- Belong to, or are employed by Taituarā — Local Government Professionals Aotearoa, New Zealand Local Government Association Incorporated, or Civic Financial Services Ltd;

- Are employed by Marsh Limited;

- People who are immediate family members of, or are wholly or partially financially dependent on, a person in one or more of the classes of person described in paragraphs (a) to (c) above. “Immediate family member” means the person’s spouse, civil union partner, de facto partner, parent, child, step-parent, or step-child.

At the date of this product disclosure statement, the Scheme’s investment policies do not take account of ‘responsible investment’, including environmental, social, and governance considerations.

However, each of the Scheme’s underlying fund managers applies responsible investment principles to the funds the Scheme invests in. This includes restrictions on investing in companies that operate in certain industries.

We regularly review the underlying fund managers’ approach to responsible investment and take it into account when deciding whether to appoint an underlying fund manager. Please contact us for further details at any time.

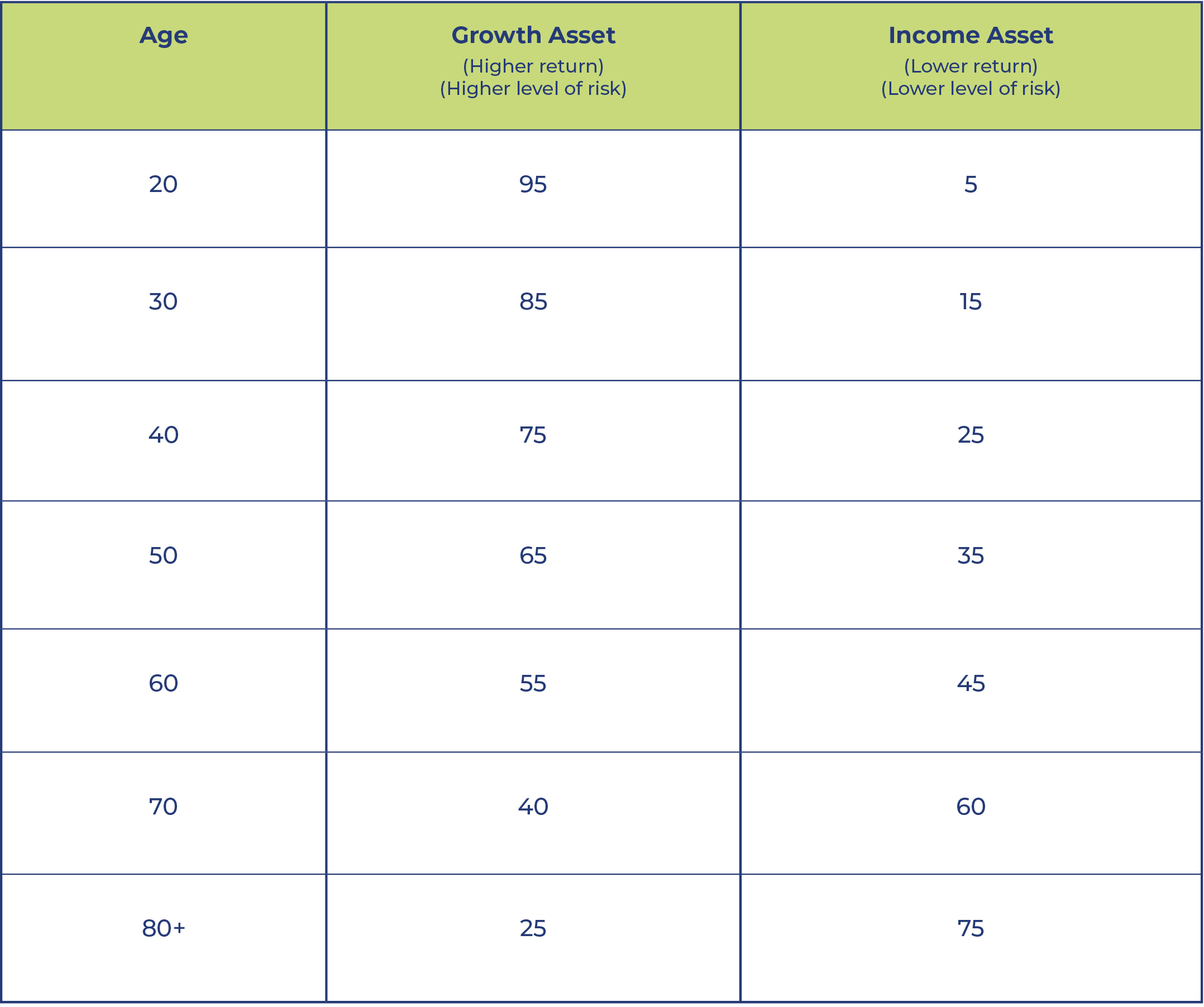

The Automatic Fund is a life cycle investment option, which as you grow older will automatically and smoothly change your target investments to a more conservative investment mix.

The Automatic Fund has been designed solely for the purpose of retirement savings and is exclusive to members of the SuperEasy KiwiSaver Superannuation Scheme and SuperEasy Employer Scheme.

The investment objectives of the Automatic Fund are to try to achieve an appropriate long-term outcome for investors by accepting a higher investment risk and return volatility in the early stages of a member’s working life as a trade-off for potentially higher returns. When a member is younger, the Automatic Fund provides greater exposure to investments with the potential for growth such as overseas and New Zealand equities.

Each month, between the ages of 20 and 80, the Automatic Fund will automatically and smoothly change a member’s target investments to a slightly more conservative mix. Thus the member’s target exposure to income assets such as fixed interest securities and cash is slightly increased every month and the exposure to growth assets is correspondingly decreased.

This option is suitable for members who wish to start with a relatively high proportion of growth assets, but for that proportion to reduce over time, and who want the rebalancing done on a monthly basis without having to organise this for themselves.

As the Automatic Fund adjusts members’ target investments based on age, it is a life cycle investment option for the purposes of the FMCA.

The Automatic Fund has target asset allocations which are set by the Scheme’s Trustee from time to time, and which depend on the member’s age. The initial allocation is based on the age of the member when they enter the fund. Each month the member’s savings will be reviewed against the targets that are set out in the table below:

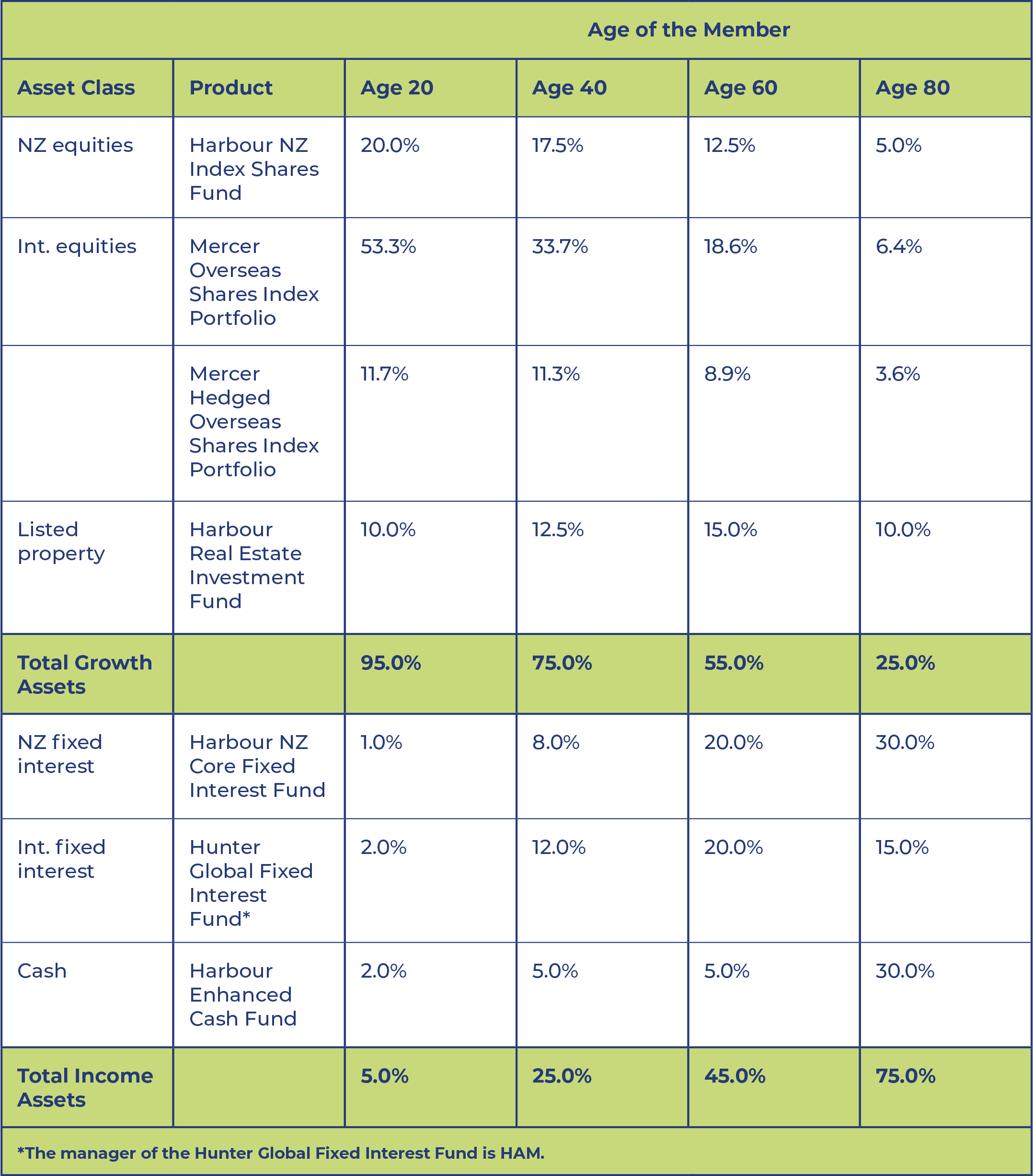

Within each of these asset classes, the current target asset allocation of the Automatic Fund has a range of investments, including overseas equities (hedged and un-hedged), Trans-Tasman equities, property, overseas and New Zealand fixed interest securities and cash. The Fund’s target asset allocation is set out in the table below:

Harbour Asset Management Limited and Mercer New Zealand jointly manage the underlying assets in the Automatic Fund.

Mercer New Zealand Limited

Mercer New Zealand is a company that has helped New Zealanders manage their retirement savings for over 65 years and manage $15 billion on behalf of New Zealand investors. Mercer globally is one of the world’s largest managers of third-party funds with $600 billion of client funds under management.

Harbour Asset Management Limited

As at 30 April 2021, Harbour Asset Management Limited has over $6 billion of funds under management.

More information on this Fund is available in the SuperEasy KiwiSaver Superannuation Scheme Product Disclosure Statement, Statement of Investment and Policy Objectives, and the Scheme’s register entry www.disclose-register.companiesoffice.govt.nz.

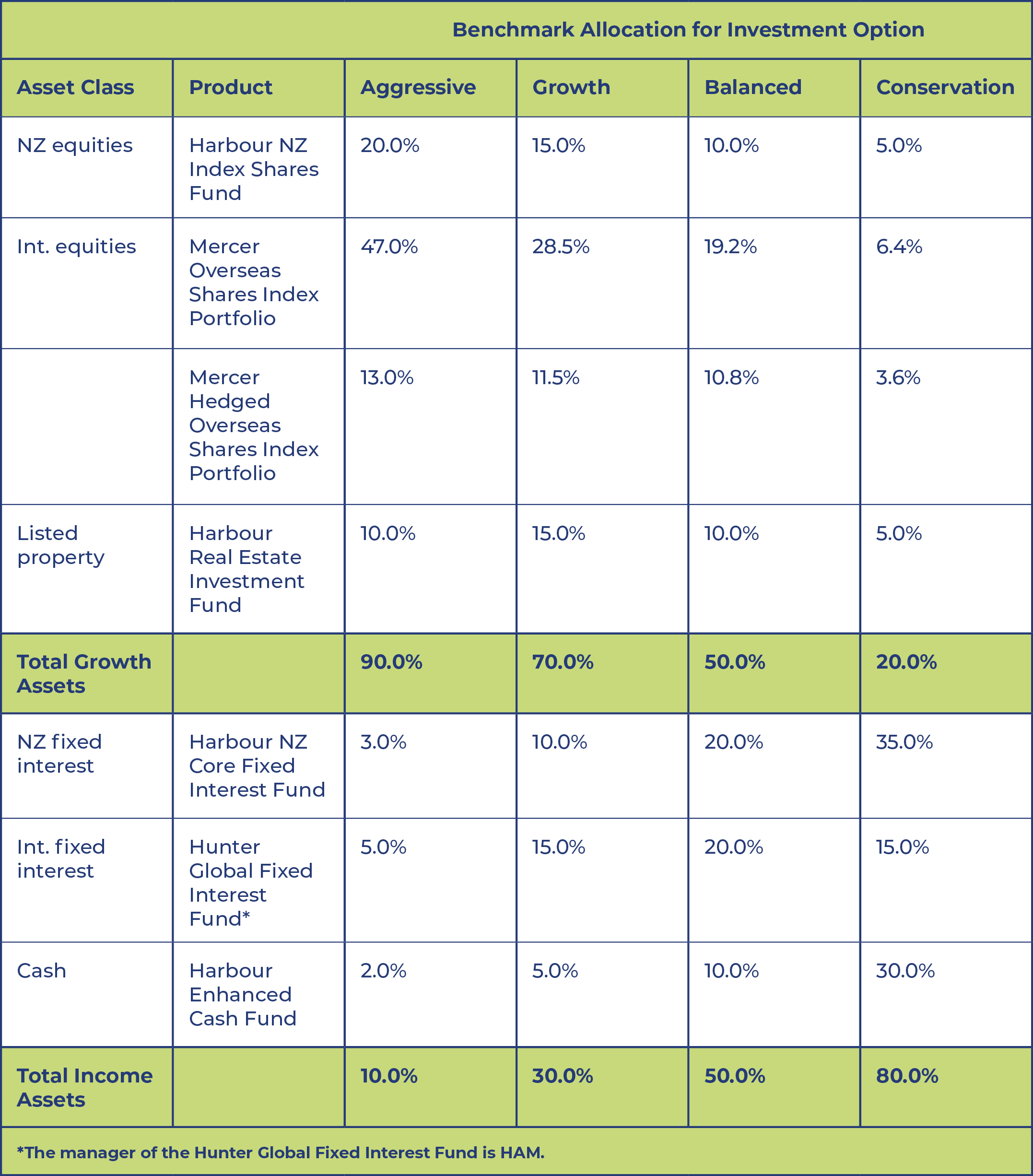

Each of these four Funds has a different investment objective and pursues a different investment strategy. Your return will depend principally on the investment option you choose.

The different objectives mean different proportions are invested in different assets. However, the objectives of these Funds, as set by the Scheme’s Trustee from time to time, are indicated by the asset allocations applicable. These are summarised as follows:

Within each of these asset classes, the current target asset allocation of each Fund has a range of investments, including overseas equities (hedged and un-hedged), Trans-Tasman equities, property, overseas and New Zealand fixed interest securities and cash. The target asset allocation of these Funds is set out below:

Aggressive Fund

The investment objectives of the Aggressive Fund are to achieve a high level of real returns over the medium to long term primarily through substantial investment in equities, accepting that the returns may be subject to significant short-term variations. More specifically,

• the Aggressive Fund’s investment objective is to achieve a real rate of return (after tax at the highest PIR rate and after investment fees and costs) of 2.00% pa over rolling five year periods;

• it is expected to have a negative return frequency of 1 in 3.0 years, using the investment modelling assumptions adopted by the investment consultant.

This option is suitable for members willing to take a reasonable amount of risk for potentially higher but more volatile returns over the long term.

The target asset allocation of this Fund is set by the Scheme’s Trustee from time to time. The current target is indicated in the diagram below.

Harbour Asset Management and Mercer New Zealand jointly manage the underlying assets in the Aggressive Fund.

Mercer New Zealand Limited

Mercer New Zealand is a company that has helped New Zealanders manage their retirement savings for over 65 years and manage $15 billion on behalf of New Zealand investors. Mercer globally is one of the world’s largest managers of third-party funds with $600 billion of client funds under management.

Harbour Asset Management Limited

As at 30 April 2021, Harbour Asset Management Limited has over $6 billion of funds under management.

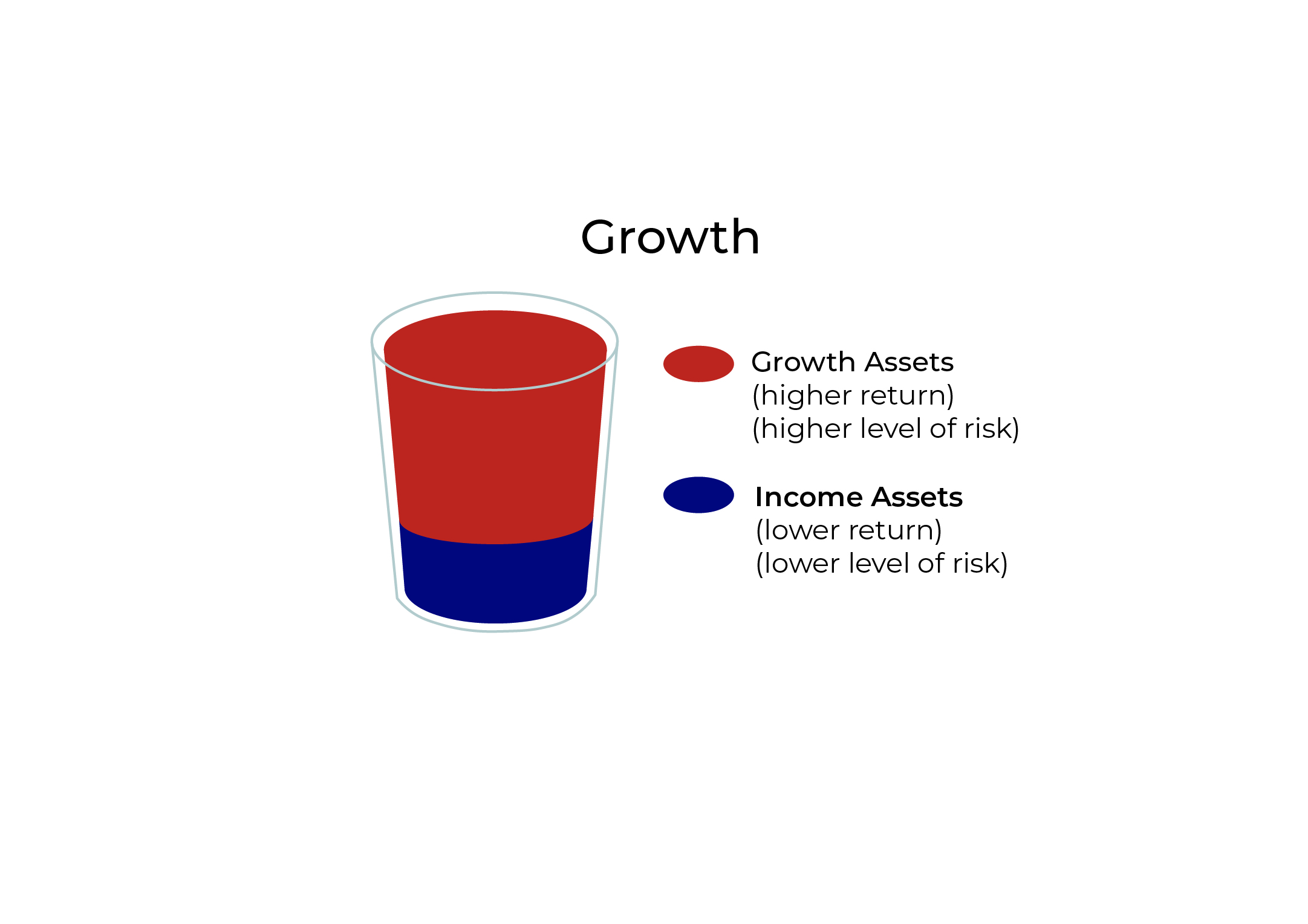

Growth Fund

The investment objectives of the Growth Fund are to achieve positive real returns over the medium to long term through investment in growth assets, while managing volatility through diversification of the Fund’s assets. More specifically,

• The Growth Fund’s investment objective is to achieve a real rate of return (after tax at the highest PIR rate and after investment fees and costs) of 1.50% pa over rolling five year periods;

• it is expected to have a negative return frequency of 1 in 3.5 years, using the investment modelling assumptions adopted by the investment consultant.

This option is suited to members seeking long term growth with risk limited by broad diversification. It is intended to be less volatile than the Aggressive Fund, and therefore may realise lower returns over the longer term.

The target asset allocation of this fund is set by the Scheme’s Trustee from time to time. The current target is indicated in the diagram below.

Harbour Asset Management Limited and Mercer New Zealand jointly manage the underlying assets in the Growth Fund.

Mercer New Zealand Limited

Mercer New Zealand is a company that has helped New Zealanders manage their retirement savings for over 65 years and manage $15 billion on behalf of New Zealand investors. Mercer globally is one of the world’s largest managers of third-party funds with $600 billion of client funds under management.

Harbour Asset Management Limited

As at 30 April 2021, Harbour Asset Management Limited has over $6 billion of funds under management.

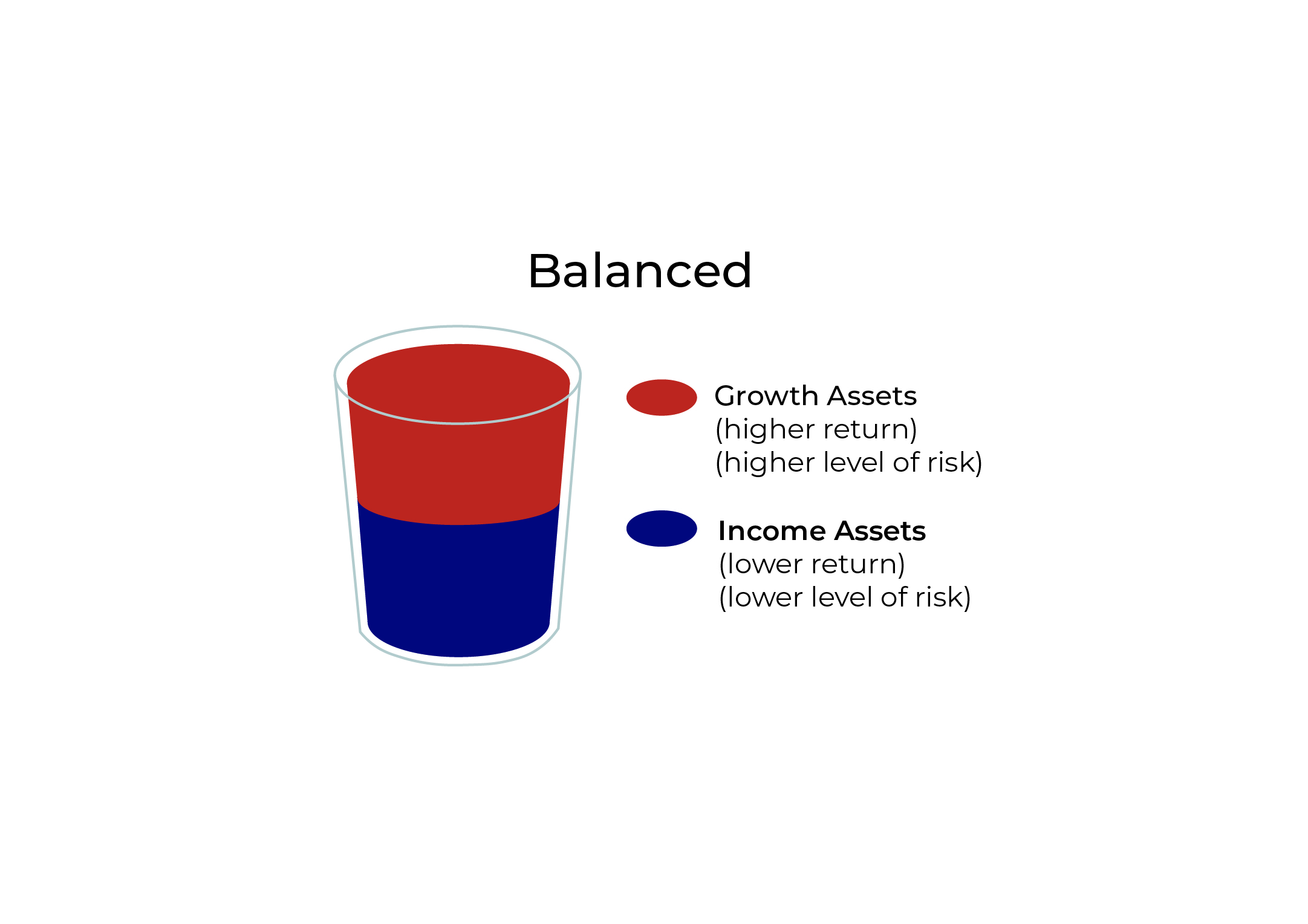

Balanced Fund

The investment objectives of the Balanced Fund are to achieve positive real returns over the medium to long term through investment in a balanced mix of growth and income assets. More specifically,

• the Balanced Fund’s investment objective is to achieve a real rate of return (after tax at the highest PIR rate and after investment fees and costs) of 0.75% pa over rolling five year periods;

• it is expected to have a negative return frequency of 1 in 4.0 years, using the investment modelling assumptions adopted by the investment consultant.

This option is suited to members seeking a return profile which balances medium term growth with risk. It is intended to be less volatile than the Growth Fund, and therefore may realise lower returns over the longer term.

The target asset allocation of this fund is set by the Scheme’s Trustee from time to time. The current target is indicated in the diagram below.

Harbour Asset Management Limited and Mercer New Zealand jointly manage the underlying assets in the Balanced Fund.

Mercer New Zealand Limited

Mercer New Zealand is a company that has helped New Zealanders manage their retirement savings for over 65 years and manage $15 billion on behalf of New Zealand investors. Mercer globally is one of the world’s largest managers of third-party funds with $600 billion of client funds under management.

Harbour Asset Management Limited

As at 30 April 2021, Harbour Asset Management Limited has over $6 billion of funds under management.

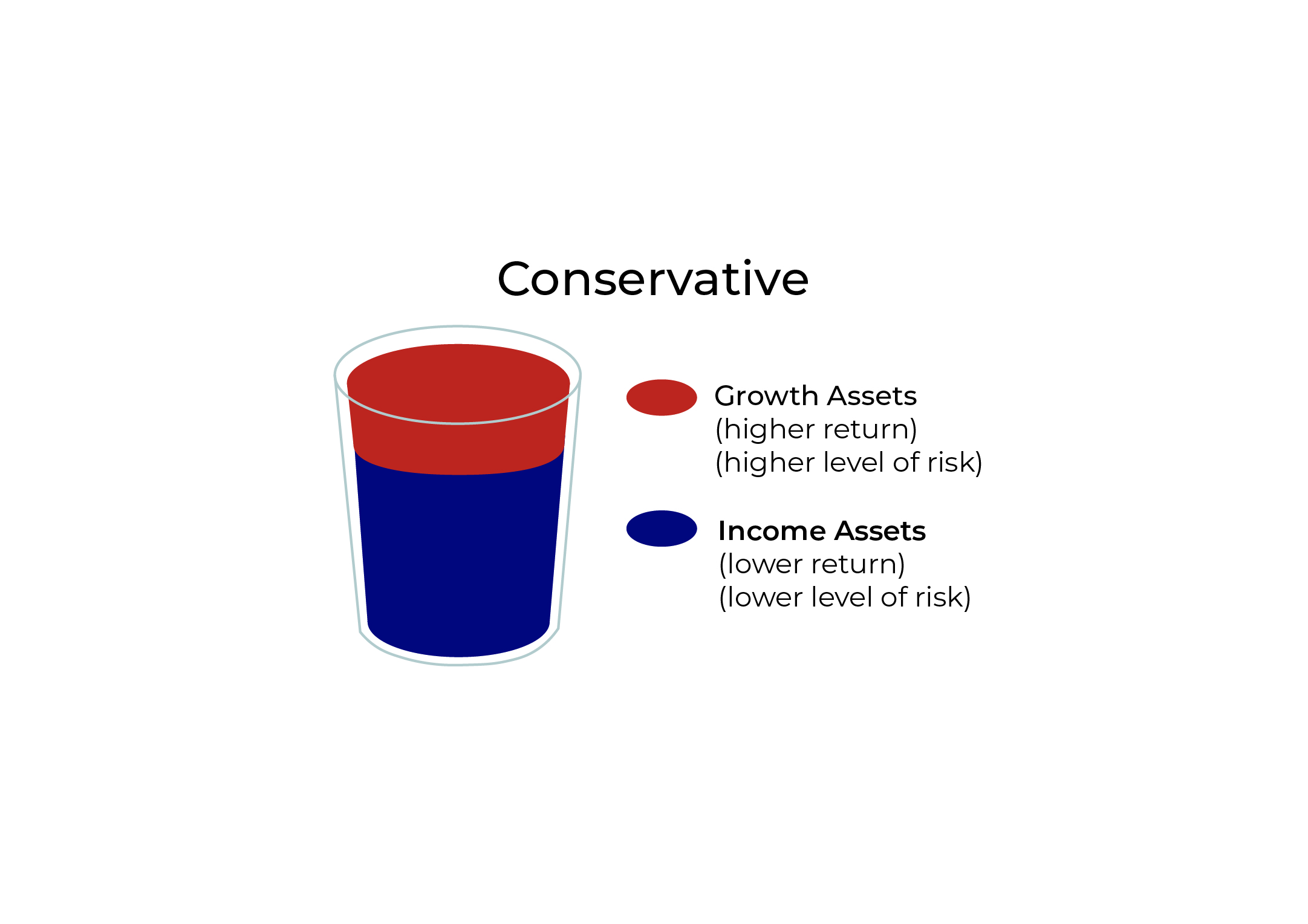

Conservative Fund

The investment objectives of the Conservative Fund are to reduce the likelihood of negative returns over the short term with higher proportions of investment in defensive assets, such as cash and bonds, while still providing an opportunity for positive real returns over the longer term by investing a smaller proportion of the assets in growth assets such as equities and property. More specifically,

• the Conservative Fund’s investment objective is to achieve a real rate of return (after tax at the highest PIR rate and after investment fees and costs) of 0.00% pa over rolling five year periods;

• it is expected to have a negative return frequency of 1 in 5.5 years, using the investment modelling assumptions adopted by the Investment Consultant.

This option is suited to members seeking low volatility and low risk. It is intended to provide a low chance of a negative return, and therefore may realise lower returns.

The target asset allocation of this fund is set by the Scheme’s Trustee from time to time. The current target is indicated in the diagram below.

Harbour Asset Management Limited and Mercer New Zealand jointly manage the underlying assets in the Conservative Fund.

Mercer New Zealand Limited

Mercer New Zealand is a company that has helped New Zealanders manage their retirement savings for over 65 years and manage $15 billion on behalf of New Zealand investors. Mercer globally is one of the world’s largest managers of third-party funds with $600 billion of client funds under management.

Harbour Asset Management Limited

As at 30 April 2021, Harbour Asset Management Limited has over $6 billion of funds under management.

More information about these funds is available in the SuperEasy KiwiSaver Superannuation Scheme Product Disclosure Statement, Statement of Investment and Policy Objectives, and the Scheme’s register entry www.disclose-register.companiesoffice.govt.nz.

You wish to join the SuperEasy KiwiSaver Superannuation Scheme and:

- You work for a Local Authority or Council Controlled Organisation

- You are an immediate family member of someone working for a Local Authority or Council Controlled Organisation

- You are an immediate family member of someone working for a Local Authority or Council Controlled Organisation and you are under 18

You will receive an acknowledgement letter from Civic Financial Services Ltd, as the administration manager, advising you of your plan details, including your individual password and access code to the Member Services section of the SuperEasy Web site: www.supereasy.co.nz/Account/Login

The SuperEasy KiwiSaver Superannuation Scheme was established on 15 June 2007 for New Zealand citizens and those eligible to be in New Zealand indefinitely. It provides retirement benefits for those people who have some connections with local government in New Zealand (whether as a local government employee or immediate family member of such a person). The Scheme was registered as a restricted KiwiSaver scheme on 1 April 2016.

The Trustee of the Scheme is Local Government Superannuation Trustee Ltd (LGST).

The address of the Trustee is:

Civic Chambers

7th Floor

116 Lambton Quay

Wellington 6011

P O Box 5521

Wellington 6140

Telephone: (04) 978 1250

The Administration Manager of the Scheme is Civic Financial Services Ltd. The address is:

Civic Chambers

7th Floor

116 Lambton Quay

Wellington 6011

P O Box 5521

Wellington 6140

Telephone: (04) 978 1250

For more information visit the Civic Financial Services Ltd website; www.civicfs.co.nz